Annual results 2024: GF resilient amid challenging markets – strategic transformation underway

This is an ad hoc announcement pursuant to Article 53 of the Listing Rules (LR) of the SIX Exchange Regulation AG.

The Annual Report 2024 and the presentation of the financial year 2024 are available on GF’s website www.georgfischer.com/en/investors/reports-and-presentations/annual-report.html.

The 2024 results briefing for analysts and journalists will be held on 26 February 2025 at 10:00 a.m. CET. Please use the following link to join the live webcast.

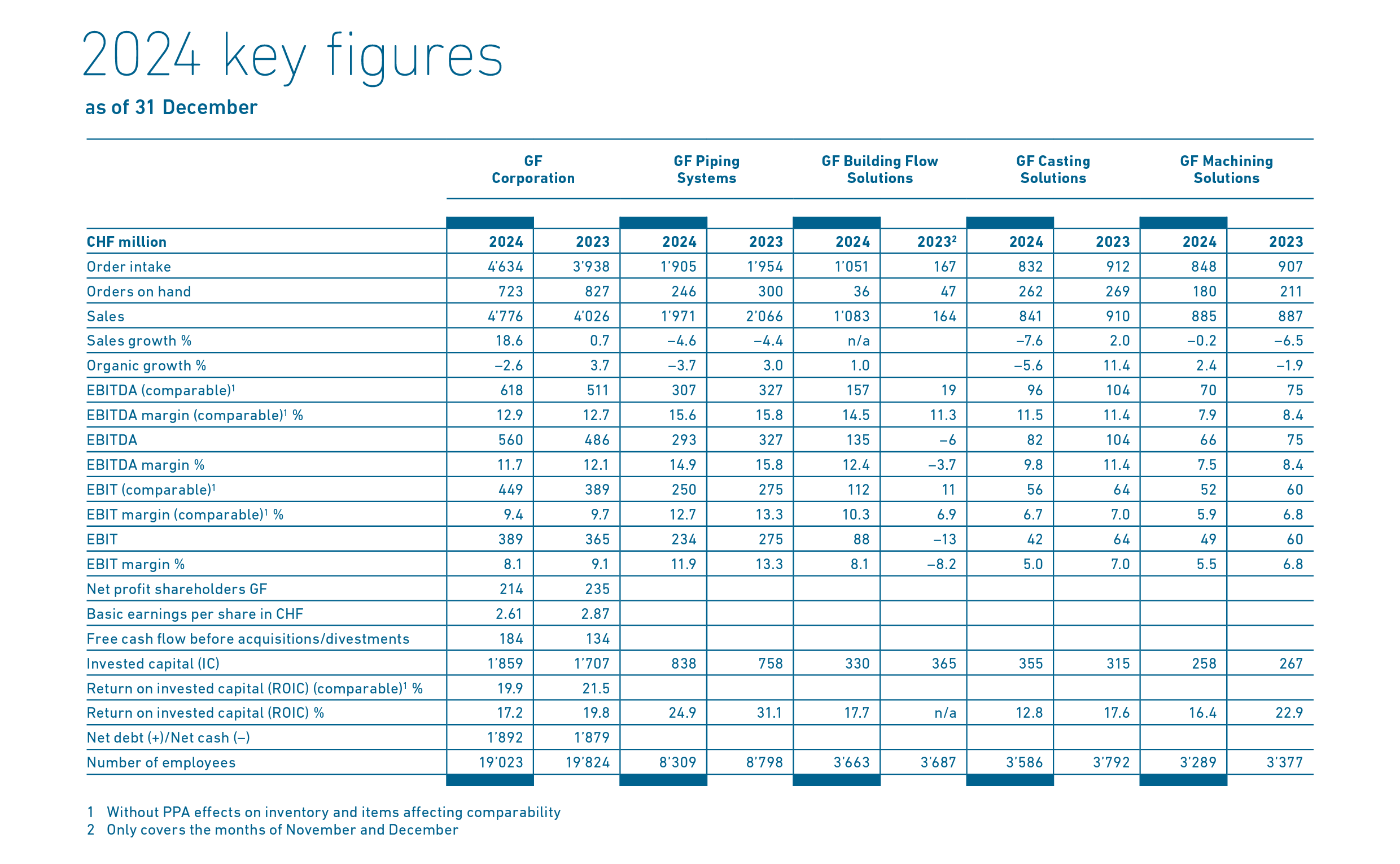

- Sales reached CHF 4’776 (4’026) million, up 18.6%; sales organically declined by 2.6%

- Solid comparable operating result (EBIT) of CHF 449 (389) million, with a comparable EBIT margin of 9.4% (9.7%). Reported operating result was CHF 389 (365) million, with a margin of 8.1% (9.1%)

- Divestment of GF Machining Solutions on track; evaluation process for GF Casting Solutions ongoing

- Uponor integration well underway, division renamed GF Building Flow Solutions

- Successful placement of CHF 650 million in bonds with favorable conditions

- GF Board proposes a dividend of CHF 1.35 (1.30) per share for 2024

(Figures in brackets, unless otherwise stated, refer to the same period in the previous year.)

Andreas Müller, CEO GF, says: “2024 was an exceptional year for GF. We delivered a very solid performance in a turbulent environment and took decisive steps to transform our organization. We further strengthened our operational excellence and made great progress with regard to sustainability, creating a strong foundation for the opportunities ahead. This progress would not have been possible without the dedication of our employees, and I am truly grateful for their support during this transformation and their role in shaping GF’s future as an industry leader.”

In 2024, GF announced the most significant transformation in its corporate history to become the global leader in Flow Solutions. Over the course of the year, GF once again demonstrated its resilience amid persistently challenging markets, adversely affected by ongoing geopolitical tensions, the strong Swiss franc and sluggish construction and automotive sectors in Europe.

In line with the announced new strategic direction, GF signed an agreement to divest GF Machining Solutions to United Grinding Group, a Swiss-based global leader in grinding technology. The transaction is expected to close in the first half of 2025. The divestment of GF Machining Solutions allows GF to increase its strategic flexibility in order to pursue further growth opportunities as well as value-generating investments in Flow Solutions for Industry, Infrastructure and Buildings. Additionally, an evaluation of strategic options for GF Casting Solutions, a leader in lightweight casting components, is underway.

The integration of Uponor is well on track. Key achievements in 2024 included the combination of Uponor's infrastructure business with GF Piping Systems, while GF Piping Systems’ Building Technology business was moved to GF Building Flow Solutions. GF laid the foundation for future commercial synergies by introducing a complementary combined GF Building Technologies and Uponor product offering to customers around the world. A new compelling innovation pipeline for Building Flow Solutions will be unveiled at ISH, the leading European plumbing trade fair, in March 2025. Another milestone was the creation of a joint procurement team for GF Piping Systems and GF Building Flow Solutions, which led to an immediate increase in efficiency and cost savings. Synergies (value creation program) amounted to CHF 17 million, above the target communicated in mid-year 2024.

In response to soft markets, GF additionally announced in mid-2024 the launch of a company-wide performance improvement program to lower the 2024 cost base by CHF 50 million. The program progressed according to plan and the target amount was reached. GF’s strong market position, combined with its innovation capability and cost improvement program, played a key role in partially offsetting the challenging market conditions.

GF is making significant progress towards its sustainability objectives for 2025. Sales from products or solutions that deliver social or environmental benefits for GF’s customers reached 76%1 (2023: 68% excluding acquisitions), exceeding the 74% target2 set for 2025. Additionally, Scope 1 and 2 CO2e emissions decreased by 50% compared with the 2019 baseline. GF’s safety performance also improved, achieving a low accident rate. As a result, GF was awarded the prestigious “A” score from the global rating agency CDP in recognition of its transparency and achievements in addressing climate change. By 2026, GF plans to establish net-zero targets aligned with the 1.5°C pathway recommended by the Paris Agreement. This underscores the strategic importance of sustainability, which is firmly embedded in GF’s daily business activities. Furthermore, focusing on the Flow Solutions business increases GF’s attractiveness to all stakeholders by addressing global challenges such as water scarcity, energy efficiency and sustainability.

________________

1The data point includes the acquisitions made end of 2023.

2At the end of 2023, GF acquired the company Uponor, which subsequently became GF’s fourth division, GF Building Flow Solutions, in 2024. In light of this acquisition, GF has revised its baseline and objectives within the Sustainability Framework 2025 to incorporate GF Building Flow Solutions. The revised objectives maintain the same level of ambition and reduction as those established prior to the acquisition, as detailed in the Sustainability Statement.

Solid performance despite market slowdown

Order intake reached CHF 4’634 (3’938) million, despite challenges in the European construction industry and the automotive sector, as well as delays in industrial projects worldwide.

GF sales in 2024 amounted to CHF 4’776 (4’026) million. Organically, sales decreased by 2.6%. Currency effects negatively affected sales by CHF 128 million.

Comparable operating result (EBIT) excluding PPA effects on inventory and items affecting comparability reached CHF 449 (389) million, with a comparable EBIT margin of 9.4% (9.7%). Reported operating result (EBIT) stood at CHF 389 (365) million, with an EBIT margin of 8.1% (9.1%). Comparable operating result before depreciation and amortization (EBITDA) reached CHF 618 (511) million and reported EBITDA reached CHF 560 (486) million.

The comparable return on invested capital (ROIC) was 19.9% (21.5%), and ROIC was 17.2% (19.8%).

Free cash flow before acquisitions reached CHF 184 (134) million, despite the impact of acquisition financing costs and certain items affecting comparability, with a cash effect in the range of CHF 80 million. Financing costs will decrease significantly following the company’s successful refinancing through corporate bonds and the completion of the announced divestment. In November 2024, GF raised CHF 650 million on the Swiss debt capital market in two tranches: CHF 300 million for 3 years at a coupon of 1.25% and a 7-year bond of CHF 350 million at 1.55%. This marked the largest bond issuance in GF’s history and GF’s balance sheet remained healthy.

Net profit attributable to shareholders of GF amounted to CHF 214 (235) million.

At the upcoming Annual Shareholders’ Meeting, the Board of Directors will propose a dividend per share of CHF 1.35 (1.30).

At the end of 2024, GF employed 19’023 (19’824) people.

IMPORTANT NOTE: The following results for the GF Building Flow Solutions division (formerly GF Uponor) still reflect the former GF Uponor’s activities. The organizational changes that have been implemented (moving the Building Technology segment from GF Piping Systems to GF Building Flow Solutions, and Uponor Infrastructure from GF Building Flow Solutions to GF Piping Systems) will be reflected in financial reporting starting with the 2025 results.

GF Piping Systems

GF Piping Systems’ order intake reached CHF 1’905 (1’954) million and sales reached CHF 1’971 (2’066) million. Order intake and sales were negatively affected by delays in microelectronics projects and overall weaker markets, in particular in the APAC region.

The division’s comparable EBIT stood at CHF 250 (275) million, resulting in a comparable EBIT margin of 12.7% (13.3%), which is within the range of the Strategy 2025 targets. Reported EBIT was CHF 234 (275) million, with an EBIT margin of 11.9% (13.3%). The impact of currency movements on the division’s EBIT was minus CHF 20 million. Profitability was supported by the value creation program and the cost-saving initiatives.

The division made significant inroads into the Marine and Cooling business, backed by key framework agreements with global customers, partially offsetting subdued market segments such as microelectronics. The division also strengthened its presence in the promising Gulf region markets, with an expansion of prefabrication capabilities in Abu Dhabi (UAE) and the opening of new sales offices in the region. In North Africa, it inaugurated a new plant in Cairo (Egypt), paving the way for future growth.

GF Building Flow Solutions

GF Building Flow Solutions (formerly GF Uponor) reached sales of CHF 1’083 million. While markets in North America showed solid development throughout the year, demand in Europe remained subdued. Joint cross-divisional commercial activities in the US, as well as in Europe, provided positive momentum.

Excluding the PPA effects on inventory related to the Uponor acquisition and items affecting comparability, comparable EBIT amounted to CHF 112 million, with a comparable EBIT margin of 10.3%. Reported EBIT was CHF 88 million, with an EBIT margin of 8.1%. Operating margin development was supported by cost-saving initiatives and the value creation program.

Significant efforts were made to streamline combined operations. These efforts included procurement savings and manufacturing footprint optimization, such as closing the division's plant in Sanliurfa (Turkey) and the addition of a new factory in Poland to strengthen the division's presence in Eastern Europe. The integration of Building Technologies’ and Uponor’s product and solution portfolios resulted in comprehensive attractive application categories, including hot and cold water supply and controls, heating and cooling solutions, wastewater systems and special applications. These attractive offerings enable GF to deliver exceptional services and innovative solutions to customers worldwide.

GF Casting Solutions

GF Casting Solutions’ sales amounted to CHF 841 (910) million and were impacted by lower demand in the automotive sector in the second half of the year, especially in Europe. Due to setbacks in the transition to e-mobility, e-vehicle-related sales in Europe declined by 11%.

This shortfall was only partially offset by continued strong demand for e-vehicles in China and an ongoing rebound in the aerospace sector. Die-casting lifetime orders for the division came in at CHF 1’358 (912) million thanks to a well-balanced customer portfolio and solutions for propulsion-independent components.

The division’s comparable EBIT stood at CHF 56 (64) million, resulting in a comparable EBIT margin of 6.7% (7.0%). Items affecting comparability relate to the closure of operations in Werdohl (Germany). Reported EBIT was CHF 42 (64) million, with an EBIT margin of 5.0% (7.0%). Pricing actions to compensate inflationary effects contributed positively to profitability.

GF Machining Solutions (discontinued operations)

GF Machining Solutions’ order intake reached CHF 848 (907) million thanks to a strong development in China and in the aerospace and energy segments. Sales reached CHF 885 (887) million. Organic sales growth was 2.4%. Comparable EBIT for 2024 was CHF 52 (60) million, with a comparable EBIT margin of 5.9% (6.8%). Reported EBIT was CHF 49 (60) million, with an EBIT margin of 5.5% (6.8%). The aerospace sector was the most dynamic market throughout the year, offsetting sluggish demand in the electronics sector.

GF’s transformation is underway

Following the landmark acquisition of Uponor, the integration is progressing smoothly, with a strong focus on cost and sales synergies. Employee events have played a key role in supporting the integration of Uponor, fostering a unified “One GF culture” while honoring the heritage of both brands.

In October 2024, an agreement was signed to divest GF Machining Solutions to the Swiss grinding machines company United Grinding Group (UGG). Closing is scheduled for the first half of 2025. In line with GF’s new strategic focus, the evaluation process to identify the best strategic options for GF Casting Solutions is also underway. In the meantime, GF Casting Solutions remains fully committed to maintaining all operations and pursuing its Strategy 2025 targets.

GF is well positioned to capture growth and seize the opportunities offered by its new strategic focus on providing innovative and sustainable Flow Solutions for the industrial, infrastructure and building sectors.

Upon completion of its transformation, GF expects an average organic growth range of 4-6% per year over the new 2026-2030 strategy period, with an EBIT margin gradually increasing to the 13-15% range, an EBITDA margin between 16-18%, a free cash flow/ EBITDA conversion above 50% and a ROIC between 21-26%.

2025 outlook for the Flow Solutions business

In line with the company’s new strategic direction, GF’s guidance on the outlook for 2025 applies only to its future core activities, the Flow Solutions businesses.

Despite persistent short-term global challenges, GF will benefit from long-term market trends driven by an attractive semiconductor industry, liquid cooling for data centers, increasing investments in sustainable water management including advanced stormwater systems and safe drinking water solutions in buildings and urban areas, and growing demand for energy-efficient buildings and for critical industrial systems that require reliable transport of fluids.

For the full-year 2025, the GF Group expects flat to lower single-digit organic growth and profitability before items affecting comparability in the range of 10.5-12.5% for the EBIT margin, 13.5-15.5% for the EBITDA margin and 20-24% for ROIC. These figures apply only for the Flow Solutions business excluding the divisions identified for divestment (GF Machining Solutions) or under strategic review (GF Casting Solutions).

For further information please contact

Beat Römer, Head Corporate Communications

+41 (0) 79 290 04 00, media@georgfischer.com

Nadine Gruber, Head Investor Relations

+41 (0) 79 698 14 87, ir@georgfischer.com

Photos of the Analyst and Media Conference will be available on 26 February 2025 as of 2:00 p.m. in the GF image database.

GF uses certain key figures to measure its performance that are not defined by Swiss GAAP FER. For that reason, there might be limited comparability to similar figures presented by other companies. Additional information on these key figures can be found on www.georgfischer.com/en/investors/alternative-performance-measures.html

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CFO Mads Joergensen at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CFO Mads Joergensen at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CFO Mads Joergensen at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CFO Mads Joergensen at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CFO Mads Joergensen at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CFO Mads Joergensen at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

Nadine Gruber, Head Investor Relations, at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

Nadine Gruber, Head Investor Relations, at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

CEO Andreas Müller at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

Beat Römer, Head Corporate Communications, at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

Beat Römer, Head Corporate Communications, at the GF Analyst and Media Conference on 26 February 2025 in Zurich (Switzerland)

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

GF, with a rich history in industrial innovation, is actively reshaping itself to become the global leader in Flow Solutions for Industry, Infrastructure and Buildings. With its divisions, GF Piping Systems and GF Building Flow Solutions, GF delivers essential products and solutions that enable the safe and efficient transport of liquids and gases worldwide. As part of its strategic transformation, GF is divesting its GF Machining Solutions division and is evaluating strategic options for its GF Casting Solutions division. Founded in 1802, GF is headquartered in Switzerland and present in 46 countries with 184 companies, 74 of which are production companies as per end of 2024. GF employs about 19’000 professionals and generated sales of CHF 4’776 million in 2024. GF is listed on the Swiss stock exchange.

Share