Resilient amid challenging market conditions

This is an ad hoc announcement pursuant to Article 53 of the Listing Rules (LR) of the SIX Exchange Regulation AG.

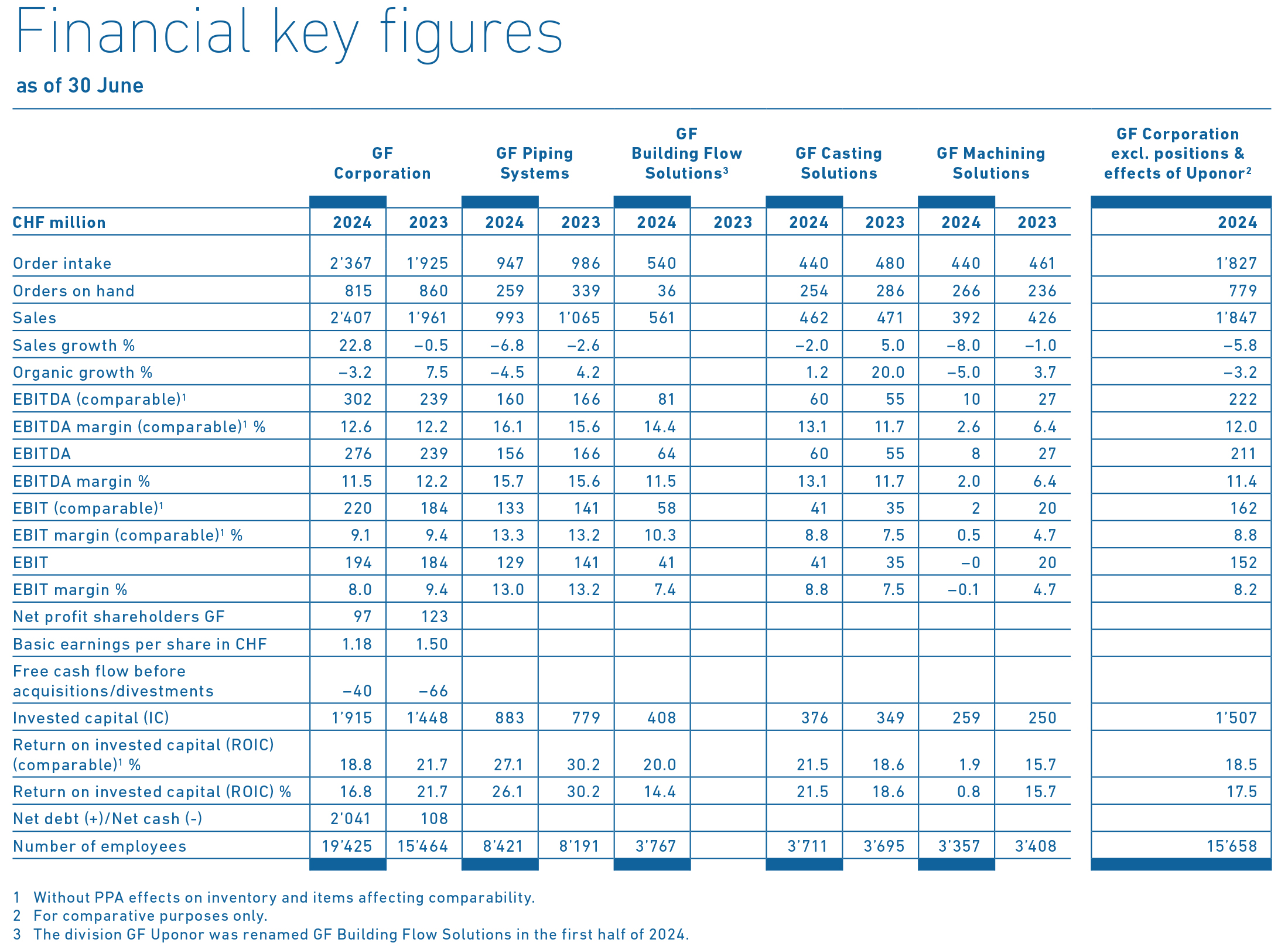

- Sales reached CHF 2'407 million, up by 22.8% (2023: CHF 1'961 million); organic sales were 3.2% below the first half of 2023

- Comparable operating result (EBIT) amounted to CHF 220 million at a margin of 9.1%

(2023: CHF 184 million, EBIT margin of 9.4%). Reported EBIT of CHF 194 million (EBIT margin 8.0%) - Corporate-wide performance improvement program launched in response to soft markets, reducing 2024 cost base by CHF 50 million

- Organizational integration of the Building Technology business into GF Building Flow Solutions (formerly GF Uponor) and of Uponor Infra into GF Piping Systems well on track. Synergy potential fully reconfirmed, contributing well above CHF 15 million of additional EBIT for 2024, gradually increasing to CHF 50 million until 2027

- Business momentum in the second quarter of 2024 accelerated, setting the stage for a solid performance for the full year 2024 with comparable profitability expected in the strategic target corridor

Andreas Müller, CEO GF, says: "The first half of 2024 was characterized by challenging conditions across selected market segments, especially in the first quarter. However, our increased focus on the flow business with GF Piping Systems and GF Building Flow Solutions, coupled with our balanced global presence, allowed us to partially offset subdued demand in areas such as the soft semiconductor sector and the construction industry in Europe. In the second quarter, the growing positive momentum in various markets makes us confident that we will see positive development in the second half of the year."

The uncertain economic environment and ongoing geopolitical tensions negatively impacted customer sentiment, particularly in the capital goods sector. The strong Swiss franc and a weak construction market in Europe negatively affected GF's 2024 half-year result. GF swiftly initiated performance improvement programs, across all divisions, aimed at reducing the 2024 cost base by CHF 50 million.

The integration of Uponor continues to be ahead of plan. Currently, focus is being placed on procurement synergies and a sharpened organizational setup, which is accelerating customer and business focus. The value creation program following the acquisition is forecast to create annual synergies in the amount of CHF 40-50 million at full run rate by 2027, of which more than CHF 15 million additional EBIT will be achieved in 2024.

To realize the targeted potentials, a new organization has been put in place. GF Building Flow Solutions (formerly GF Uponor) is responsible for the Building Technology business, while GF Piping Systems is focusing on the industrial and infrastructure business, including the former Uponor Infra business. This is not yet reflected in the segment reporting in the financial statements.

65% of GF's sales are today related to the water and flow solutions business. This increases GF's resilience in times of volatile markets and provides a strong and credible foundation for GF's ambition to become the global leader in sustainable water and flow solutions. Furthermore, the strong presence of the former Uponor in the US contributes to a better balanced global footprint: Europe currently accounts for around 50% of sales, whereas approximately 20% of sales are attributable to Asia and the Americas respectively.

IMPORTANT NOTE: The following results for the GF Building Flow Solutions division (formerly GF Uponor) still reflect the former GF Uponor activities. The organizational changes that have been implemented (Building Technology segment from GF Piping Systems to GF Building Flow Solutions, and Uponor Infrastructure from GF Building Flow Solutions to GF Piping Systems) will be reflected only as of the 2025 results.

Group results

Order intake reached CHF 2'367 million, which is CHF 442 million above the first half of 2023. Sales amounted to CHF 2'407 million (2023: CHF 1'961 million), 22.8% above the previous year's level. After the slow start at the beginning of the year, business gained momentum in the second quarter of 2024. The main growth driver was the consolidation of the activities from the Uponor acquisition completed in November 2023. Currency effects negatively affected sales by CHF 89 million, partially offset by pricing measures.

The operating result (EBIT) reached CHF 194 million, compared with CHF 184 million in the first six months of 2023, with a corresponding EBIT margin of 8.0% (2023: 9.4%). PPA (purchase price allocation) effects on inventory related to the Uponor acquisition and other items affecting comparability amounted to CHF 26.5 million, implying a comparable EBIT margin of 9.1% (2023: 9.4%).

Net profit attributable to GF shareholders amounted to CHF 97 million, compared with CHF 123 million in the first half of 2023.

Free cash flow before acquisitions/divestments came in at minus CHF 40 million (2023: minus CHF 66 million).

GF is well on track to reach the targets set out in its Sustainability Framework 2025. This includes targets relating to the share of GF's portfolio with products having social or environmental benefits, the reduction of CO2e emissions, as well as the unrecycled waste and water intensity index, and a diversity and inclusion target.

In a significant further step towards sustainability and innovation leadership, GF announced its ambition to reach net-zero greenhouse gas (GHG) emissions by 2050. Within the next 24 months, GF will strive to define targets in line with the 1.5-degree trajectory recommended by the Paris Agreement.

For the fourth consecutive year, GF was named one of Europe's Climate Leaders by the Financial Times, one of the world's leading business newspapers, thus further solidifying its position in this area. This recognition underlines GF's focus on sustainability and rewards the company's progress in addressing climate change.

GF Piping Systems

GF Piping Systems demonstrated its resilient global presence again in the first half of 2024. The utility and infrastructure business was driven positively by projects in Brazil and Indonesia, balancing a slow start to the year in Europe due to adverse weather conditions at the beginning of 2024. The industrial rebound in the US and a resilient European market ensured solid development in industrial water treatment. The shift of several large projects from Asia to Europe and the Americas led to temporarily weaker microelectronics sales, which did not, however, affect the positive long-term trend in this sector.

Sales in the first half of 2024 came close to the one billion mark and amounted to CHF 993 million (2023: CHF 1'065 million). Organically, sales decreased by 4.5%. The comparable operating result stood at CHF 133 million (2023: CHF 141 million), at a comparable EBIT margin of 13.3% (2023: 13.2%). The reported operating result came in at CHF 129 million, with a reported EBIT margin of 13.0%. Currency effects negatively impacted sales by CHF 61 million, and operating result by CHF 15 million.

For the second year in a row, GF Piping Systems was named one of the 2024 Best Places to Work in Orange County, CA (US).

In May 2024, GF Piping Systems' new plant in Yangzhou (China) received three-star certification for green industrial building design, the highest level for such projects in China.

GF Building Flow Solutions (formerly GF Uponor)

Uponor, the company acquired in November 2023, is now focusing exclusively on the building technology business under its new division name GF Building Flow Solutions. The division offers one-stop-shop solutions for efficient indoor climate control, hot and cold water supply, as well as water quality systems for residential and commercial buildings.

In the first six months of 2024, the newly consolidated GF Building Flow Solutions division reached sales of CHF 561 million. Excluding the non-cash PPA effects on inventory related to the Uponor acquisition and one-time items affecting comparability, the comparable EBIT amounted to CHF 58 million with a comparable EBIT margin of 10.3%. Reported EBIT was CHF 41 million with an EBIT margin of 7.4%.

This performance was primarily driven by the robust construction market in the Americas. Although the latest economic figures for Europe show signs of a recovery and its renovation market demonstrated some resilience, the construction market continues to face strong headwinds. However, with its sharpened divisional setup, GF Building Flow Solutions will be even better prepared to capture future opportunities as soon as the European construction business starts to rebound. Uponor Infra's contribution to the reported figures was relatively weak, predominantly caused by the adverse weather conditions in the first quarter in the Nordics.

With its latest divisional innovation, the "Siccus Mini" drywall underfloor heating systems launched in January 2024, GF Building Flow Solutions is setting new standards when it comes to energy efficiency and convenience of installation for underfloor heating in renovation or modernization projects. With its low installation height, fast installation time and reduced CO2 emissions compared to traditional solutions, it benefits installers, builders as well as end users.

GF Casting Solutions

E-mobility in China continued to gain momentum, driving increased demand for lightweight components from GF Casting Solutions. As at the end of June 2024, the share of high-pressure die casting lifetime orders related to e-vehicles was 60%. In China, e-vehicle-related sales grew by 25%. Together with strong sales in the aerospace and industrial segment, this partially offset reduced call-offs in the European automotive market.

Sales at GF Casting Solutions amounted to CHF 462 million compared with CHF 471 million in the first half of 2023 (organic sales growth of 1.2%). Operating result increased further to CHF 41 million (2023: CHF 35 million), resulting in a strong EBIT margin of 8.8%, which is 1.3 percentage points higher compared with the first six months of 2023.

The division demonstrated its innovation capabilities with a new version of the Cross Car Beam, which was developed following customer requests for an alternative cockpit design. The component allows for more legroom, integration of the head-up display and maximized crash performance. Moreover, it can be manufactured on existing machines – a clear advantage when it comes to investments for the car industry.

The ramp-up of the two plants in Shenyang (China) and Piteşti (Romania), both dedicated to the production of advanced lightweight components, is proceeding according to plan. After only one year of operation, Shenyang already contributed positively to the result.

GF Casting Solutions has started planning a new, state-of-the-art high-pressure die casting facility in Augusta, GA (US), based on an already committed, full order book. Operations are expected to start in 2027.

GF Machining Solutions

For GF Machining Solutions, the first half of 2024 developed quite heterogeneously, with two distinctly different quarters. The machine tool business experienced a slow start into 2024, impacted by a general hesitation to invest in capital goods within the Chinese and European markets. Consequently, the EDM sector and particularly the milling business in Europe faced challenges. However, the second quarter showed a significant improvement in sentiment with a noticeable upturn in momentum in China and an acceleration in activity in the ICT (information and communication technologies) segment.

The division reached an order intake of CHF 440 million (2023: CHF 461 million), which slightly improved in the second quarter and exceeded the same quarter in the previous year. This resulted in an improved book-to-bill ratio above 1. Sales amounted to CHF 392 million in the first half of the year (2023: CHF 426 million), organic sales were minus 5.0%, supported by strong performance in the laser and advanced technology segment as well as a continued strong order book for aerospace and energy. Comparable EBIT was at CHF 2.1 million with a comparable EBIT margin of 0.5%. Reported EBIT was negative at CHF -0.5 million (2023: CHF 20 million), corresponding to a negative EBIT margin of -0.1%.

GF Machining Solutions has again demonstrated its innovative strength and reinforced its leadership as a supplier of automated ultra-precise, high-performance machine tools.

Its latest innovation paves the way for the future of laser micro machining and 3D surface processing operations across a broad range of industries, including ICT and medical (eg, orthopedic implants). The ability to integrate processes, technology and dedicated software brings significant value to customers by reducing manufacturing costs and increasing energy efficiency.

Outlook for the full year 2024

GF does not expect the current macroeconomic and political challenges to ease significantly in the short to medium term. Nevertheless, GF is well positioned to benefit from global megatrends such as the demand for clean (drinking) water, energy-efficient climate solutions in residential and commercial buildings, sustainable mobility and high-precision manufacturing.

Positive and partly accelerated momentum in the industry business in North America and the Chinese automotive market, as well as strengthening in the microelectronic business and the ongoing strong order intake for the aerospace segment are expected to further support the development of the business in the second half of 2024. In addition, the implemented cost reduction measures will support profitability improvements.

Barring any unforeseen circumstances, GF continues to expect a solid performance for the full year 2024, with profitability in the strategic target corridor (comparable EBITDA margin of 13-15% and comparable EBIT margin of 10-12%).

For further information please contact

Beat Römer, Head Corporate Communications

+41 (0) 79 290 04 00, media@georgfischer.com

Nadine Gruber, Head Investor Relations

+41 (0) 79 698 14 87, ir@georgfischer.com

The presentation of the mid-year results will take place on 18 July at 9:00 a.m. via audio webcast.

GF uses certain key figures to measure its performance that are not defined by Swiss GAAP FER. Comparability to similar figures presented by other companies might therefore be limited. Additional information on these key figures can be found at www.georgfischer.com/en/investors/alternative-performance-measures.html.

With its four divisions GF Piping Systems, GF Building Flow Solutions, GF Casting Solutions, and GF Machining Solutions GF offers products and solutions that enable the safe transport of liquids and gases, as well as lightweight casting components and high-precision manufacturing technologies. As a sustainability and innovation leader, GF has been striving to achieve profitable growth while offering superior value to its customers for more than 200 years. Founded in 1802, the Corporation is headquartered in Switzerland and present in 45 countries with 187 companies, 76 of which are production companies with 105 facilities. GF’s 19’824 employees worldwide generated sales of CHF 4’026 million in 2023.

Share